rsu tax rate uk

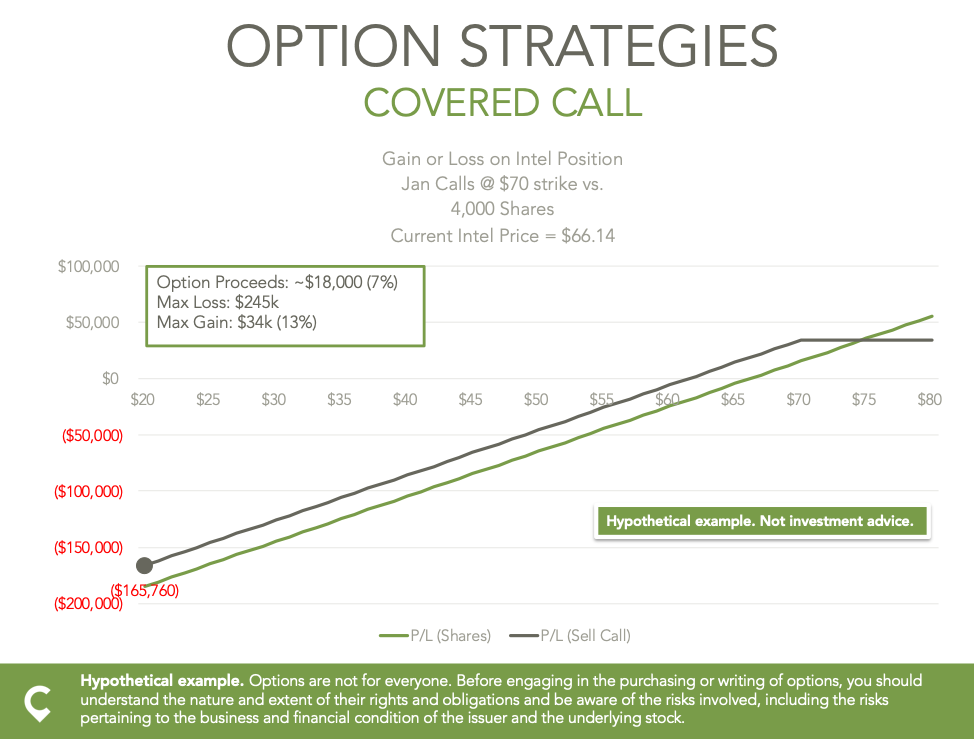

RSUs can also be subject to capital. How Are Restricted Stock Units RSUs Taxed.

Rsu Taxes Explained 4 Tax Strategies For 2022

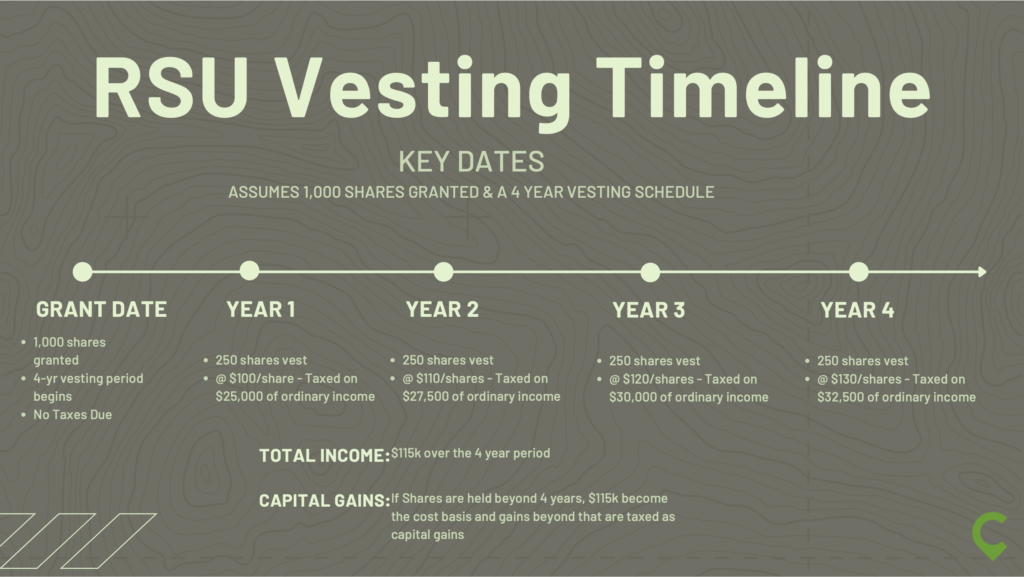

Eddy Engineer has 1000 shares that vest in April of 2022.

. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax status of the employee. How Do I Avoid Paying Taxes On Rsu. How Are Restricted Stock Units RSUs Taxed.

10000 options 30 fair market value less 10000 options 1 strike price 290000. Lets say you are granted 200 RSUs on 3112 14From your OP these will vest become yours in equal instalments over the next four anniversary dates -so 50 shares on 3112 15then 50 shares on 3112 16 etc. An RSU award is normally an.

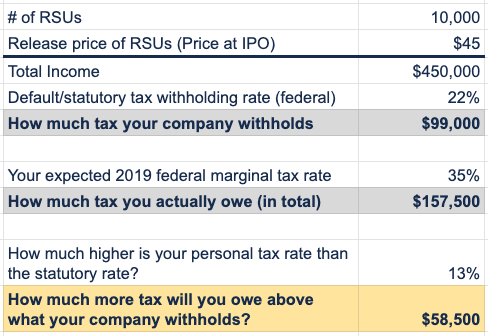

Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. This doesnt include state income Social Security or Medicare tax withholding. An RSU is granted with restriction of not being able to sell for 1 Year.

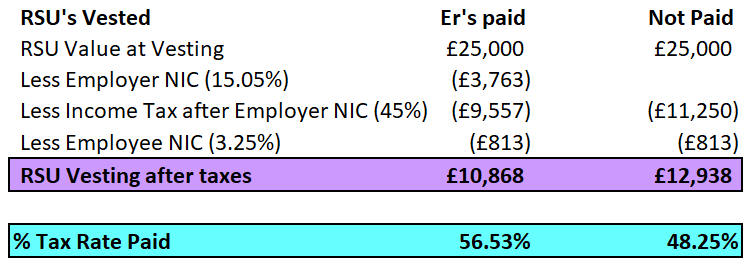

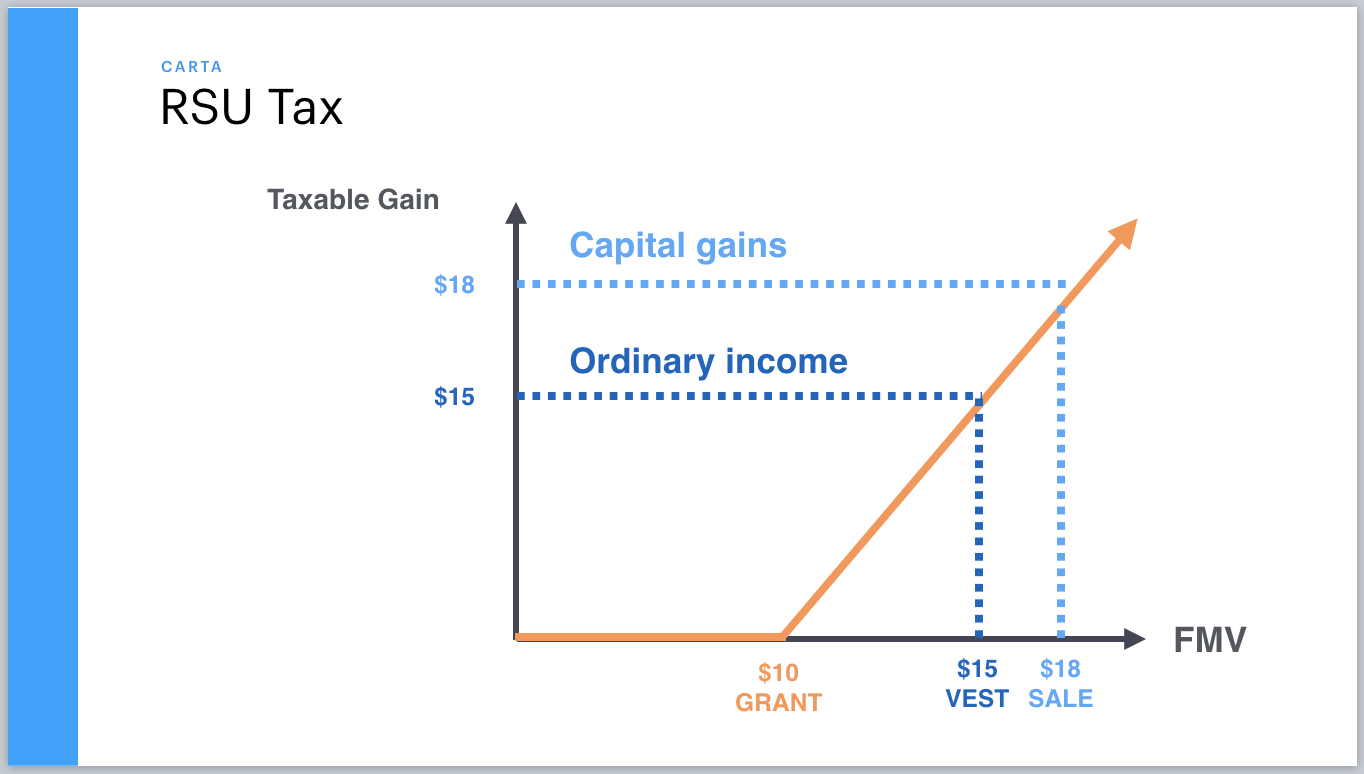

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. C if any foreign tax has already been deducted from the RSU you can claim Foreign Tax Credit Relief in the Foreign Pages of your SA return d given that you didnt become tax resident in the UK until 4 February 2022 split-year treatment is likely to apply to the 202122 tax year which we will ascertain on the basis of the info you will. Whatever the rate at which RSUs are viewed they are considered.

Tideways Guide for Tech Employees. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. Taxation of RSUs.

Here is an article on employee stock options. When you join the company you are provided with 100 restricted stock units with a four year vesting period. The gain from the sale of shares is subject to tax as capital income at 30 percent up to EUR30000 and 34 percent for the exceeding part.

RSUs receive withholdation rates of 22. Its based on your current tax rate and theres a. Rsus Can Also Be Subject To Capital.

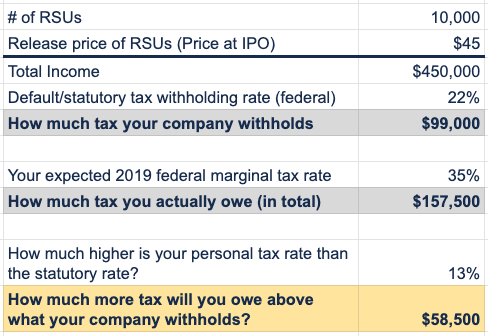

Net RSU Value Before Employer Income Tax NI. If held beyond the vesting date the RSU tax when shares are sold is. Restricted Stock Units.

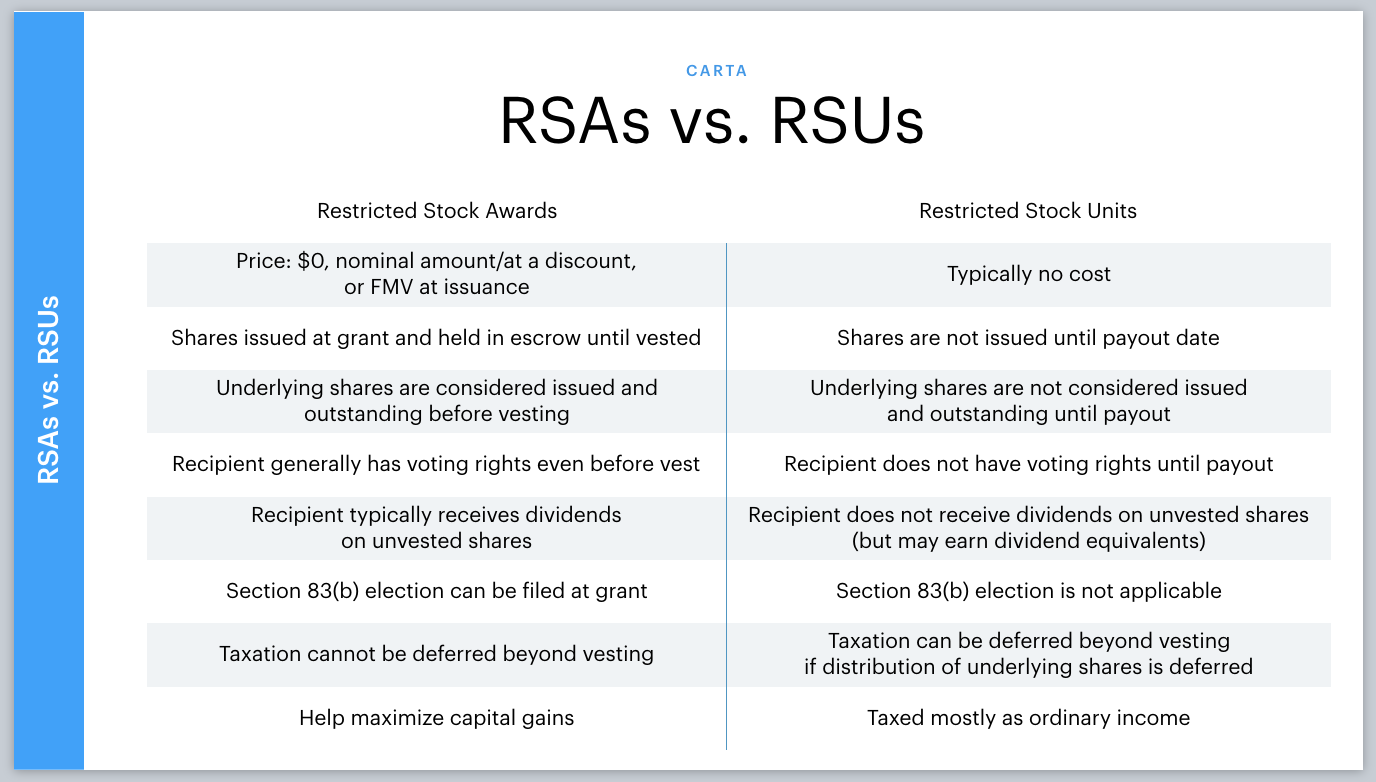

A restricted stock unit is a type of company stock that you can purchasetaxable as an income just like your RSUs. Recently we have seen an uptick in enquiries about the pros and cons of being awarded Restricted Stock Units RSUs and ways in which clients could save the potentially high rates of tax. This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised.

Restricted stock units RSU LTIPs frequently use what are known as restricted stock units or restricted share units RSUs. In reality the difference is the rsu taxes left. The of shares vesting x price of shares Income taxed in the current year.

April 9 2021 Written by Sam Ratnage. Because there is no actual stock issued at grant no Section 83 b election is permitted. RSU tax at vesting date is.

The taxation of RSUs is a bit simpler than for standard restricted stock plans. Once all the assumptions have been entered the RSU tax calculator will provide three outputs and they are all pretty self-explanatory. Estimated Taxes From RSUs Due at Vest - This shows the estimated taxes youll owe from your RSUs vesting.

In this example 25 shares will vest after one year a further 25 after the second year and so on. How Are Rsu Taxed In Uk. Step 5 - Review Outputs of RSU Tax Calculator.

If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax. Most companies will withhold federal income taxes at a flat rate of 22.

If you are awarded RSUs each unit represents one share of stock that you will be given when the units vest. Each year 25 of the RSUs vested. Sales price price at vesting x of shares Capital gain or loss.

At this point the employee is charged to income tax on 30. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. An RSU taxation example.

How Much Tax Do You Pay On Rsu Uk. Stock options that are granted in the UK are deemed non-qualified stock options and subject to UK taxation as well as income tax. If you already earn in excess of this and the RSUs take you over 150000 you will pay 45 income tax plus the employers National Insurance.

If the rsus take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers national insurance. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. For every year thereafter you are awarded an additional 100 restricted stock units.

If any gains. The value of over 1 million will be taxed at 37. RSUs form a part of an individuals income and tax.

The restricted market value was 80 and the employee paid 50. Less 40 Income Tax 40 Higher Rate Tax no lost personal allowance-6896. At any rate RSUs are seen as supplemental income.

The grant of RSUs does not incur any tax dueRSUs are taxed the same way as your salary in the UK When they vest you only pay tax on themUpon retiring to a companys tax shelter your employee national insurance will be deducted from your income. RSU Tax Treatment Key Dates. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance.

Extra tax of 4310 due to loss of personal allowance as income above 100000 employee nic 2 431.

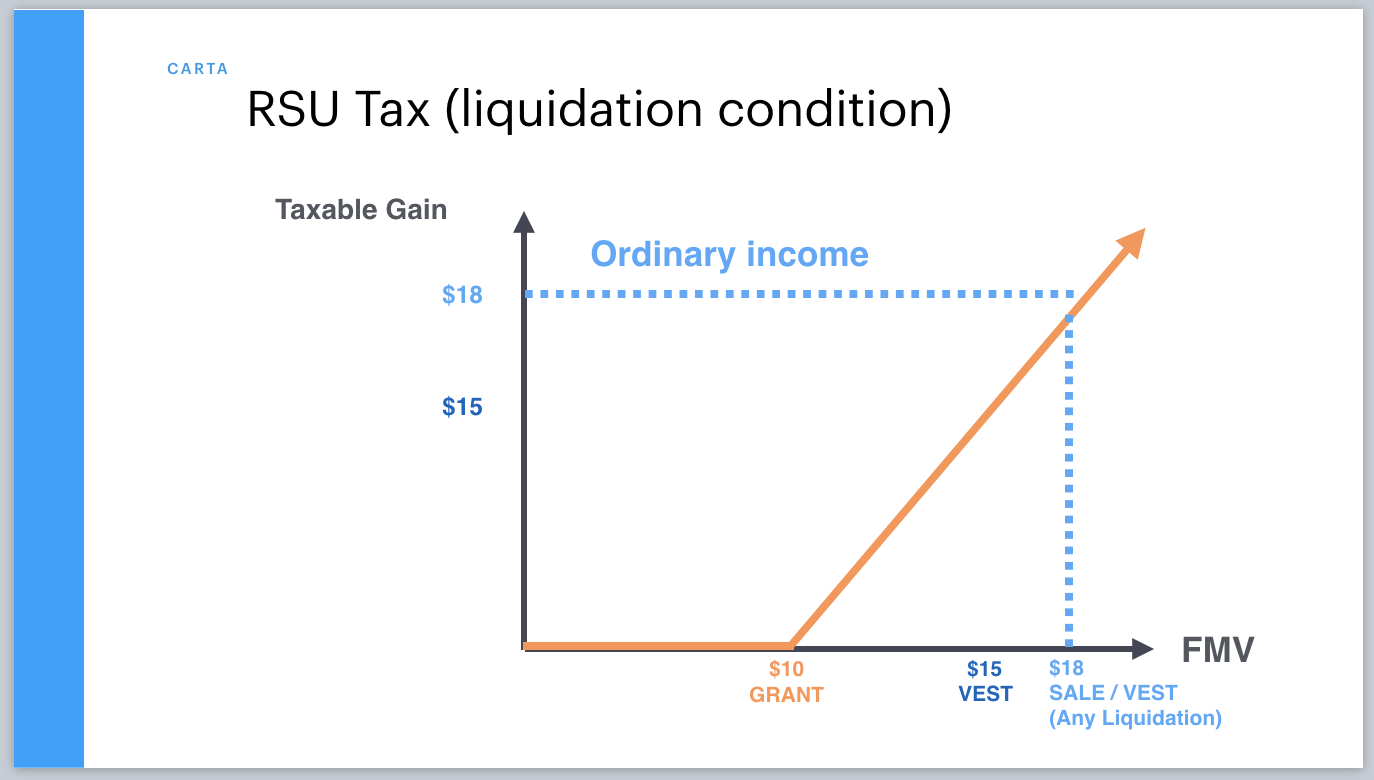

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Rsa Vs Rsu Everything You Need To Know Global Shares

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Restricted Securities Also Known As Restricted Share Units Rsu S

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

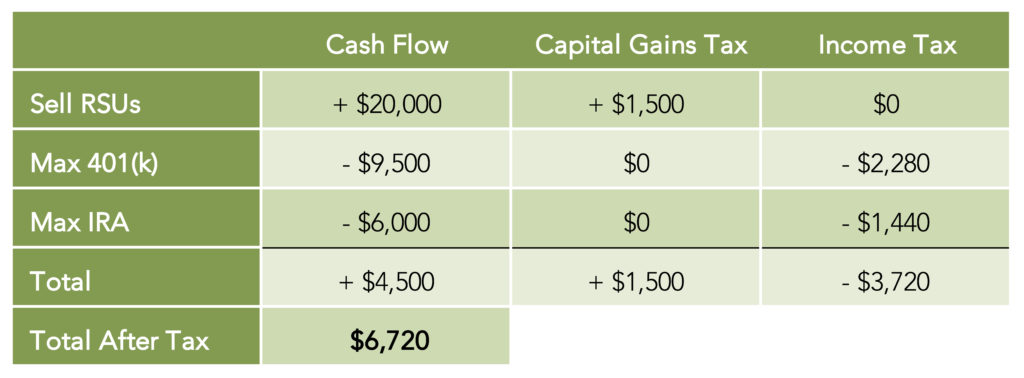

Tax Efficiency Around Rsus The Lemon Fool

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta Capital Gains Tax Salary Requirements Types Of Taxes

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

A Tech Employee S Guide To Rsus Cordant Wealth Partners

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Taxation Of Restricted Stock Units Rsus Carter Backer Winter Llp

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Comments

Post a Comment